- Coinbase introduces crypto lending platform for US institutional investors, addressing market gaps and failures.

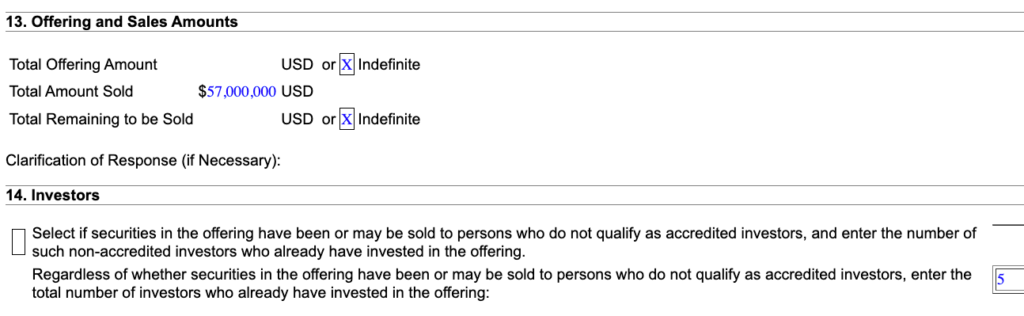

- Customers invested $57 million in the lending program, reflecting strong initial interest.

- Coinbase faces regulatory challenges in the US, leading to stock downgrades and ongoing uncertainties.

Crypto exchange Coinbase is focused on leveraging the gaps and fails in the crypto lending market by introducing an institution-grade crypto lending platform for US investors. On September 6, Coinbase announced that it is launching a crypto lending service tailored for institutional investors in the US, integrated into its existing Coinbase Prime offering.

A Coinbase spokesperson confirmed:

“Coinbase is launching a digital asset lending program for its institutional Prime clients. With this service, institutions can choose to lend digital assets to Coinbase under standardized terms in a product that qualifies for a Regulation D exemption.”

Coinbase representative

As per a filing to the U.S. Securities and Exchange Commission, customers of Coinbase have already placed $57 million into the lending program since its initial sale on August 28th. By September 1st, the offering had garnered the interest of five investors. The launch of this new product aligns with Coinbase’s commitment to modernize the century-old financial system, leveraging crypto to provide people with more economic freedom and opportunity, as noted by the Coinbase spokesperson.

Nevertheless, the lending platform was declared after the exchange unveiled its decision to discontinue the issuance of new loans through its Borrow service, a feature that permitted specific United States customers to use crypto as collateral in exchange for cash loans. On May 3, Coinbase sent an email to Coinbase Borrow users that effective May 10, customers would no longer have the option to initiate new loans through Coinbase Borrow. However, the email reassured customers that existing loans would not be affected, and no additional steps were required on their part.

BREAKING: #Coinbase announced in a shocking notice to its users that beginning on May 10, 2023, Coinbase will be abruptly terminating its Coinbase Borrow service that allowed users to take out fiat loans with cryptocurrencies set as collateral. pic.twitter.com/3ZjcudDiy5

— The Cardano Times (@TheCardanoTimes) May 3, 2023

Coinbase is experiencing a tough time amid legal battles against the US SEC and “weighed down” stocks due to the lack of crypto regularity in the US. Reports from investment analysts at Citi highlighted that Coinbase’s stock price is expected to remain under pressure until regulators in the United States establish clear legal guidelines. Moreover, the investment bank downgraded Coinbase shares from a “buy” to a “neutral” rating and reduced its price target due to the presence of “too many uncertainties.” This adjustment comes as the company grapples with regulatory challenges.

On the other hand, Coinbase recently revealed an increased bond buyback cap of $180 million, signaling its readiness to repurchase a greater portion of its outstanding Notes than previously disclosed. Moreover, the exchange extended the expiration date for the Tender Offer from its initial deadline of 11:59 p.m., New York City time, on September 1, 2023, to a revised deadline of 11:59 p.m., New York City time, on September 18, 2023. This extension provides Note holders with additional time to evaluate and take part in the offer.