- As per the latest report, US-based crypto startups accounted for over 43% of deals and 45% of capital invested by VC firms.

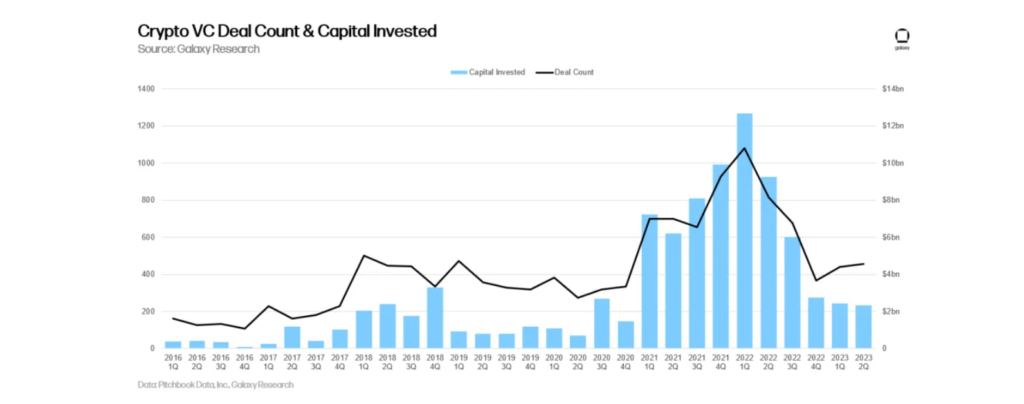

- Capital investment in crypto and blockchain startups declined quarterly, with Q2 2023 reaching the lowest since Q3 2020.

- Companies in the “broad Web3 category” had more deals, while the “trading category” raised more capital.

A recent report from Galaxy Digital, a crypto investment firm, revealed that despite facing regulatory scrutiny in the United States, crypto firms are actively engaged in innovation. The report highlighted that almost half of the capital investments are directed toward U.S. crypto businesses, indicating a substantial interest from venture capital (VC) firms in the country.

The report noted:

US-based crypto startups accounted for more than 43% of all deals completed and raised more than 45% of the capital invested by VC firms.

Meanwhile, according to the report, the United Kingdom secured 7.7% of the capital investment, while Singapore and South Korea attracted 5.7% and 5.4% respectively. However, it was observed that the overall capital invested in crypto and blockchain startups experienced a decline on a quarterly basis. The report highlighted that only $720 million was raised by 10 newly established crypto venture capital funds in the second quarter of 2023. This marked the lowest amount since the onset of the COVID-19 pandemic in the third quarter of 2020.

Additionally, the report made an observation regarding the distribution of deals and capital raised among different categories of crypto companies.

Crypto and blockchain startups raised less money across the last three quarters combined than they did in just Q2 last year.

It was found that companies falling under the “broad Web3 category” had a higher number of deals, indicating increased activity in that sector. On the other hand, companies categorized under the “trading category” managed to secure more capital, highlighting investor interest and confidence in those particular ventures.

These developments occur in the context of increased regulatory actions taken by the United States Securities and Exchange Commission (SEC) against various crypto firms in recent times. A notable case took place on July 13, involving the SEC and Ripple Labs. In this case, a judge issued a partial ruling in favor of Ripple Labs, stating that XRP should not be classified as a security when it is sold on digital asset exchanges. As a result, the value shot up 29% after the judge’s verdict.

On June 18, Ripple CEO Brad Garlinghouse expressed his belief that the SEC’s intentions are to stifle innovation and the cryptocurrency industry in the United States. Garlinghouse argued that the SEC’s handling of the Hinman speech documents in the Ripple case goes beyond a specific token or blockchain, but rather reflects the regulatory body’s overall stance toward the crypto industry.

Trying something new – some thoughts from me on the events (specifically the release of the Hinman documents) of this week. For me, this has all had a personal bent to it – and felt like it warranted some personal comments. pic.twitter.com/k4dYeQGhsN

— Brad Garlinghouse (@bgarlinghouse) June 16, 2023

Garlinghouse’s remarks followed the SEC’s consecutive actions against prominent crypto exchanges, Binance and Coinbase, on June 5 and 6. The SEC accused both exchanges of violating securities laws and offering unregistered securities.